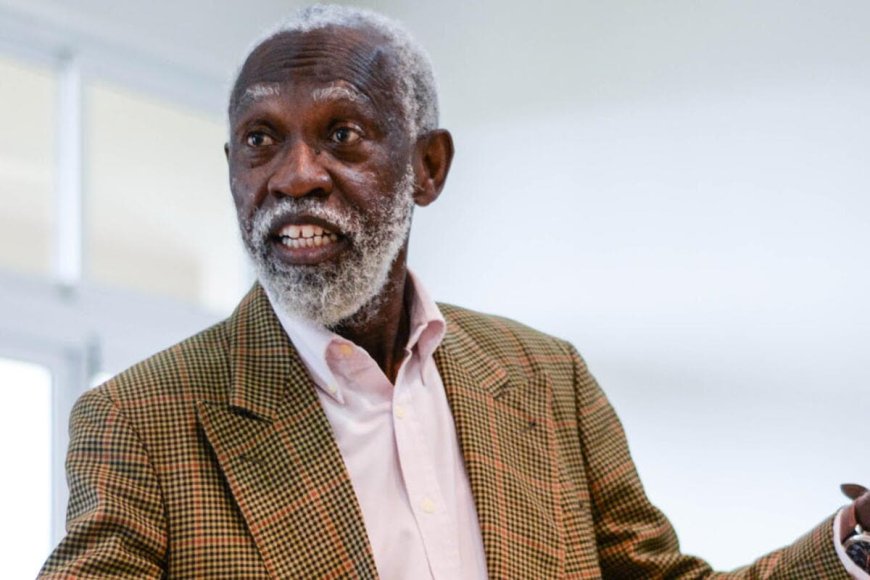

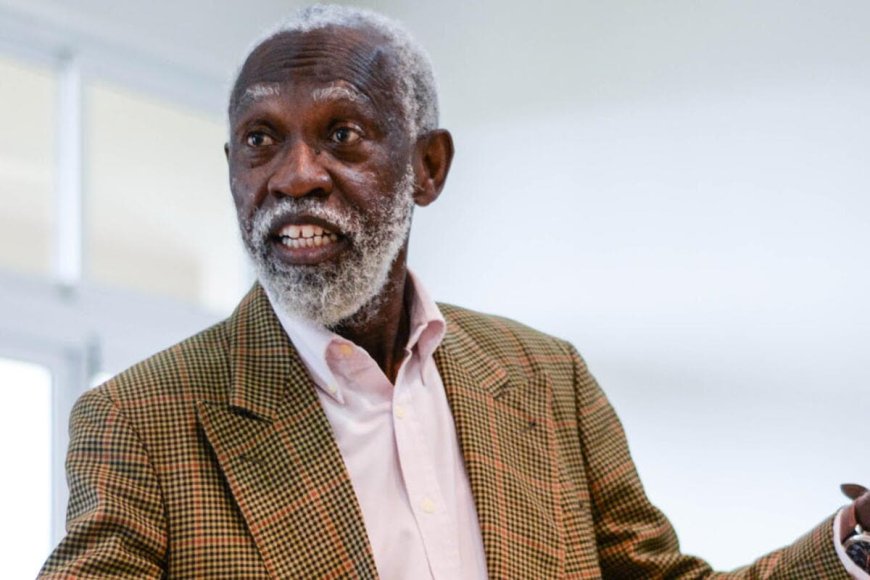

Prominent economist Professor Stephen Adei has called for a significant increase in Ghana's 10% betting tax, proposing it be raised to 50%. He argues that betting is a harmful habit that requires strong deterrents, and higher taxes could help curb its prevalence.

This suggestion contrasts sharply with a promise by President-elect John Dramani Mahama, who has pledged to eliminate several taxes within his first 100 days in office. Among the taxes Mr. Mahama plans to remove are the e-levy, the 10% betting tax, the COVID levy, the emissions levy, and import duties on vehicles and industrial and agricultural equipment.

Professor Adei’s proposal presents a direct challenge to the incoming administration's tax-relief agenda. He believes that increasing taxes on betting would help mitigate its negative societal impacts. Speaking in an interview, the former Rector of the Ghana Institute of Management and Public Administration (GIMPA) stated:

"As a father and a Christian leader, we call it a 'sin tax.' Sin taxes must be higher, not reduced. Everywhere in the world, cigarette taxes, alcohol taxes, and betting taxes are high. I would want betting taxes to be 50% because I don’t want my grandchildren to engage in betting. It is one of the most destructive habits that we must discourage."

Professor Adei also called for a comprehensive review of the country's tax system, emphasizing the need to simplify and broaden the tax base. He criticized the complexity of existing taxes, citing his experience of facing 21 different taxes while importing a vehicle, and argued for more efficient tax collection mechanisms.

"There are only about one million income taxpayers in Ghana out of 33 million people, half of whom are adults. This is why the e-levy, if reduced, should be retained. Additionally, property taxes must be prioritized because they are easier to collect, and properties cannot be hidden."

While acknowledging the political necessity for Mr. Mahama to fulfill his campaign promise to remove the e-levy, Professor Adei advised the incoming administration to consolidate taxes and focus on those that are easier and more cost-effective to collect. He warned against overpromising and highlighted the challenges of tax compliance in Ghana.

Reflecting on President Akufo-Addo's tenure, Professor Adei pointed out that the failure to manage public expectations significantly undermined his administration. He advised Mr. Mahama to learn from this and carefully manage the expectations of Ghanaians as he assumes office.

"Managing expectations is crucial in leadership—whether in a home, an organization, or a country. One of President Akufo-Addo’s downfalls was overpromising. He talked about Ghana reaching a point where we wouldn’t need aid, yet now we are relying on external support. Managing expectations should be a priority for the incoming administration."